By Tigris Asset Management | June 2025

Wall Street ended the day mixed as investors digested the sharpest slowdown in U.S. private hiring growth in over two years, adding to jitters already fueled by trade uncertainties. With the ADP National Employment Report showing just 37,000 new private-sector jobs last month — well below expectations — and ISM Services PMI dipping into contraction territory at 49.9, markets are increasingly questioning the resilience of the post-COVID economic recovery.

Let’s unpack the market reaction, what’s driving it, and what investors should watch in the short, mid, and long term.

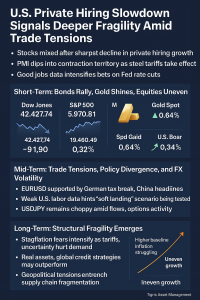

Short-Term: Bonds Rally, Gold Shines, Equities Uneven

Markets initially tried to rally on the promise of lower interest rates but ended the day with a more cautious tone:

- Dow Jones dipped 91.90 points, while the S&P 500 edged up slightly (+0.0074%) and the Nasdaq gained 0.32%.

- Treasury yields plunged across the curve, with the 10-year yield dropping over 10bps to 4.357% and the 2-year yield falling 9bps to 3.866%.

- Gold gained 0.64%, continuing its safe-haven rally amid geopolitical headlines around Russia-Ukraine tensions.

This reaction highlights a market caught between Fed cut expectations and growing skepticism about the underlying economic momentum.

Mid-Term: Trade Tensions, Policy Divergence, and FX Volatility

The U.S. private hiring slowdown comes just as trade uncertainties intensify:

- Trump’s 50% steel tariff is now in effect, putting pressure on industrial sectors and the discount retail space. Notably, Dollar Tree (-8.37%) warned of a 50% profit hit from tariffs.

- EURUSD found support around 1.1350 after Germany’s cabinet approved a 46 billion euro corporate tax break — a move that may support European growth but also signals Europe’s own worries about trade wars.

- USDJPY remains highly volatile, with spot bouncing between 142.10 and 143.00 driven by flows and option expiries. The recent JGB 30-year auction could add noise, but the bigger picture is the weakening U.S. labor data.

- In Canada, the BoC held rates at 2.75% but signaled more caution on inflation, opening the door to possible future cuts if trade risks deepen.

Market Implication: FX markets remain headline-driven and vulnerable to trade news, central bank divergence, and geopolitical developments.

Long-Term: Structural Fragility Emerges

The U.S. private hiring slowdown highlights a deeper worry: that the trade war uncertainty is starting to seep into hard data. Combined with:

- Slumping durable goods orders (-1.3%)

- First house price drop in two years

- Weak ISM Services PMI

…it’s clear the “soft landing” scenario is being tested. The risk is a stagflation-lite environment where inflation remains sticky (due to tariffs) while growth falters.

Investors need to watch for:

- The sustainability of corporate earnings amid rising input costs.

- The capacity of fiscal policy to offset trade-driven slowdowns.

- The possibility that geopolitical tensions (Russia-Ukraine, China-EU) may further entrench supply chain fragmentation, fueling higher baseline inflation.

Strategic Takeaways

Short-Term (1–2 weeks):

- Trade carefully around USDJPY and EURUSD. Option expiry clusters could fuel sharp intraday swings.

- Use gold as a hedge against geopolitical shocks — the current rally may have more room if risk sentiment deteriorates.

Mid-Term (1–3 months):

- Expect more defensive positioning as U.S. hard data continues to soften.

- Monitor central bank commentary closely — rate cut expectations are now real but remain uneven across regions.

- Consider trimming exposure to trade-sensitive equities and focusing on quality balance sheets.

Long-Term (3–6+ months):

- Position portfolios for a world where growth is harder to find, inflation is more persistent, and trade tensions remain a key risk factor.

- Real assets and global credit strategies may outperform traditional 60/40 allocations.

- Geopolitical diversification isn’t a buzzword — it’s a necessity.

Final Thought: The U.S. private hiring slowdown is more than a single data point — it’s a sign that trade tensions and policy uncertainty are beginning to erode the pillars of the recovery. Investors must think beyond short-term volatility and position for a world where structural fragility is the new normal.

No Comments