By Tigris Asset Management | May 2025

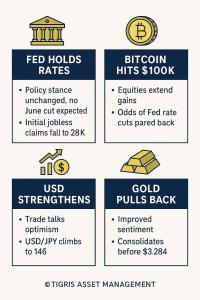

Markets are firing on all cylinders. Bitcoin crossed the $100,000 mark once again, US equities extended gains, the VIX fell, and US treasuries sold off hard. Better-than-expected jobless claims added fuel to the USD’s breakout, as traders continue to pare back expectations for a Fed rate cut in June.

But beneath the euphoria lies a more complex mix of inflation stickiness, fractured global trade alliances, and a rising USD—just as the US-China trade relationship reaches a new inflection point.

What Drove the Rally?

1. Labor Market Resilience

Weekly jobless claims came in stronger than expected:

- Initial claims fell to 228k from 241k

- Continuing claims fell to 1.879 million, a reversal from cycle highs

Much of the noise came from seasonal distortions in New York, and we expect a gradual rise through summer—but for now, the Fed sees no urgency to act.

2. Fed Rate Expectations Repriced

With inflation still elevated and no sign of labor weakness, market pricing shifted from a June cut to a July/September window, now pricing ~77bps of cuts for 2025, down from over 100bps earlier this year.

Trade Talks: Progress or Optics?

A flurry of trade headlines offered some hope, but also plenty of caution:

- US-UK Deal: Symbolic win, not an economic gamechanger. Tariffs on UK aluminum/steel fall to zero, autos to 10%, and UK agrees to buy $10bn in Boeing aircraft. Baseline 10% tariff still applies.

- US-China Talks: Treasury Secretary Bessent warned this isn’t an “advanced” discussion—just a temperature check.

- Leaked headlines: US may cut China tariffs from 145% to 50%, with South Asia tariffs possibly falling to 25%.

Tigris Take:

We see these talks as constructive but not decisive. Unless tariffs actually fall next week, we expect only tactical relief—not a full repricing of trade risk.

Gold: A Breather, Not a Breakdown

Gold pulled back overnight as optimism on US-China trade and strong job data reduced safe haven flows.

- XAU/USD trades near $3,284, testing 20-day EMA

- Chinese central bank bought 70,000 oz in April—6th straight month of accumulation

Bullish momentum remains intact with all major MAs still sloping upward.

What’s Next?

Key Data Ahead:

- China April Trade Balance

- Switzerland Consumer Confidence

- Canada Unemployment Rate

- No major US data Friday — all eyes turn to the weekend’s US-China trade talks

Tigris Insights: Positioning into the Weekend

We believe the rally in USD and risk assets is data-justified, but trade optimism is fragile. With Bitcoin soaring, gold pausing, and FX realigning, the market is running ahead of confirmation.

Our allocations:

- Private Credit: Still attractive as rates stay higher for longer

- AUD/USD Long: Fading USD peaks in risk-on windows

- Selective Gold: Buy-the-dip strategy with support at 3280

- Hedged USD/JPY positions ahead of stop-heavy resistance above 147.90

No Comments