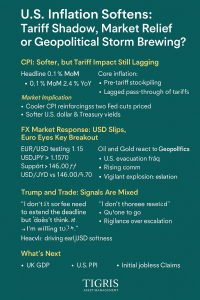

U.S. Inflation Softens: Tariff Shadow, Market Relief, or Geopolitical Storm Brewing?

By Tigris Asset Management | June 2025

Markets breathed a sigh of relief as the latest U.S. CPI data came in weaker than expected, pushing Treasury yields and the U.S. dollar lower. The data, which showed a mild 0.1% MoM increase in both headline and core CPI, suggests that the long-feared inflation resurgence may not be materializing just yet.

But beneath the surface, the picture is far from calm. Rising geopolitical tension in the Middle East, uncertain trade timelines, and fragile investor sentiment suggest that this dip in inflation might be the calm before another storm.

CPI: Softer, but Tariff Impact Still Lagging

- Headline CPI rose 0.1% MoM (vs 0.2% expected), while core inflation was also 0.1% MoM (vs 0.3% expected)

- Annual rates: Headline 2.4% YoY (in line with expectations); Core 2.8% YoY (vs 2.9% expected)

This softness is likely driven by:

1. Pre-tariff stockpiling, which delayed consumer price impact

2. Lagged pass-through of tariffs into import and consumer prices

Market Implication: The CPI surprise reinforces expectations for Fed easing — markets now price in just over two rate cuts for 2025. Treasury yields dropped across the curve, with strong demand in the 10‑year auction adding further pressure.

FX Market Response: USD Slips, Euro Eyes Key Breakout

- EUR/USD is testing the critical 1.15 level. A close above could trigger fresh momentum, with next resistance at 1.1570. Support: 1.1370

- USD/JPY dropped back below 145 as U.S. yields declined. Key support at 140.00 and 142.10, resistance at 146.00 and 148.70

- AUD and NZD saw initial bids in the NY session but retreated amid rising geopolitical risk

Market Implication: The U.S. dollar remains the key driver for G10 FX. Euro bulls will be closely watching whether the CPI‑driven momentum can push EUR/USD decisively through resistance.

Oil and Gold React to Geopolitics

The U.S. announced preparations to evacuate its embassy in Iraq, sending a chilling reminder of ongoing risks in the Middle East.

• Crude oil surged over 4.3%

• Gold jumped 1%, benefiting from safe‑haven flows

Market Implication: Commodity markets remain tightly wound. Any escalation between the U.S. and Iran could create significant tail risks for oil and gold.

Trump and Trade: Signals Are Mixed

Early morning headlines saw Trump signal flexibility on extending trade deadlines, but also reiterated a unilateral tariff plan within two weeks. Markets initially responded with USD softness, though risk appetite remains fragile.

“I don’t think it will be necessary [to extend the deadline], but I would be willing to.” — Trump

“Highly likely we’ll extend if there’s ‘good faith’” — Scott Bessent

What’s Next

Today’s market focus shifts to:

• UK GDP

• U.S. PPI

• Initial Jobless Claims

These prints will give further insight into whether the “soft landing” narrative still holds—or if disinflation is masking deeper cracks.

Strategic Takeaways for Investors

- Short‑Term (1–2 weeks):

• Monitor EUR/USD’s test of 1.15 — a breakout may drive further G10 FX divergence

• Safe‑haven flows could intensify if geopolitical headlines escalate

• Watch oil and gold for spillovers into inflation expectations - Mid‑Term (1–3 months):

• We remain cautious on USD — softer CPI and rising geopolitical risks support further downside

• Fed rate cut expectations now more entrenched — supportive of risk assets, but volatility will rise with uncertainty - Long‑Term (3–6+ months):

• If inflation continues to undershoot, policy easing could arrive faster, but the Fed will tread carefully

• Portfolios should balance exposure to USD‑sensitive assets, commodities, and macro hedges like gold

Final Thought

U.S. inflation softens, but the story doesn’t end there. As markets celebrate cooler CPI, the world remains fragile—politically, economically, and geopolitically. The real test for investors isn’t whether inflation has peaked, but whether the world is ready for the next macro shock.

Outbound Links

- U.S. Bureau of Labor Statistics – CPI

- U.S. Treasury Auctions

- World Gold Council

- Reuters Geopolitics

- Federal Reserve Rate Expectations – CME FedWatch

Read all other articles: https://tigrisfunds.com/blog/

No Comments