Powell’s Rate Stance Amid Trump Pressure: Independence or Stubbornness?

By Tigris Asset Management | June 2025

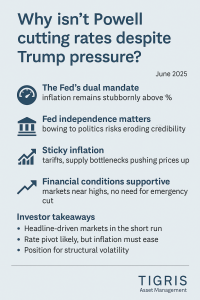

As markets navigate the turbulence of trade tensions and softening employment data, a pressing question arises: Why is Federal Reserve Chair Jerome Powell resisting calls to cut interest rates, despite mounting pressure from President Trump?

The White House has been vocal about its desire for looser monetary policy to bolster economic growth amid trade uncertainties. Yet, Powell remains steadfast, keeping rates unchanged and signaling a patient approach. Is this the mark of an out-of-touch central banker, or does it underscore the Fed’s commitment to independence?

The Fed’s Dual Mandate: Data Over Politics

The Federal Reserve’s primary responsibilities are:

- Price Stability

- Maximum Sustainable Employment

Despite trade tensions and a slowdown in private hiring—only 37,000 new jobs were added in May, the weakest in over two years (ADP National Employment Report)—the Fed views the economy as resilient. Inflation remains above the 2% target, partly due to tariffs and supply chain disruptions. Cutting rates prematurely could exacerbate inflation without addressing the underlying supply-side issues.

Market Implication: Investors should not anticipate rate cuts solely to appease political demands. The Fed’s decisions are data-driven, and persistent inflation, especially in services and rent, supports a cautious stance.

Independence Matters More Than Ever

Markets are closely monitoring Powell’s resolve. Yielding to political pressure could:

- Undermine investor confidence in the Fed’s objectivity

- Weaken the U.S. dollar, as policies appear politically motivated

- Unanchor inflation expectations, potentially driving yields higher even amid slowing growth

Powell is safeguarding the Fed’s credibility. Drawing lessons from the 1970s, when political influence led to runaway inflation, today’s Fed is determined to avoid repeating such mistakes.

Sticky Inflation: A Barrier to Rate Cuts

While headline growth indicators soften—durable goods orders down 1.3% and housing prices declining for the first time in two years—core inflation remains persistent. Tariffs and supply bottlenecks are elevating prices in services and rent, prompting the Fed to be cautious about rate cuts that could risk a stagflation scenario.

Market Implication: Bond yields may stay within a narrow range, with traders hesitant to price in aggressive rate cuts unless there’s a significant easing in core inflation.

Financial Conditions Remain Supportive

Equity markets hover near record highs, credit spreads are stable, and financial conditions haven’t tightened markedly. Despite volatility in foreign exchange and commodities, Powell sees no immediate crisis warranting emergency rate relief.

Market Implication: Equities may continue their upward trend, but volatility is more likely to stem from trade headlines than shifts in monetary policy.

Strategic Takeaways for Investors

Short-Term (1–2 weeks):

- Markets will likely remain sensitive to headlines as traders assess Powell’s commitment

- Safe havens like gold and the U.S. dollar may benefit from ongoing trade tensions and geopolitical risks

- Foreign exchange pairs such as USD/JPY and EUR/USD could experience volatility based on data surprises

Mid-Term (1–3 months):

- Should inflation ease and growth data deteriorate, the Fed might consider a measured rate cut

- Trade policies remain unpredictable; tariffs can simultaneously fuel inflation and hinder growth

Long-Term (3–6+ months):

- Powell’s stance reflects a Fed committed to its independence

- Structural volatility, driven by trade tensions and fiscal uncertainties, is likely to persist

- Investors should prepare for increased volatility and seek selective opportunities in real assets and global credit markets

Final Thought

Powell’s refusal to cut rates under political pressure is a deliberate choice, emphasizing that monetary policy is most effective when guided by data rather than politics. Investors anticipating rate cuts as political concessions may be disappointed. Those who comprehend the Fed’s long-term strategy—balancing credibility, inflation, and growth—will be better equipped to navigate a landscape where headlines can be misleading.

Outbound Links

- Federal Reserve Monetary Policy

- ADP National Employment Report

- U.S. Treasury Yields

- Reuters: Trump’s Pressure on the Fed

- World Gold Council

Read all other articles: https://tigrisfunds.com/blog/

No Comments