Over the weekend, President Trump stunned markets by doubling steel tariffs from 25% to 50% — a move that’s rattling the steel and aluminum industry and challenging the fragile stability of global trade. The policy shift is aimed at supporting the Nippon-US steel deal, marking a stark departure from Trump’s previous stance. This unexpected escalation adds yet another layer of uncertainty to an already jittery market. (Reuters)

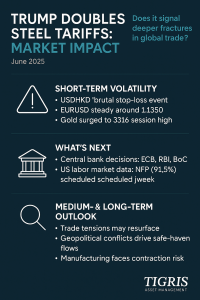

But is this latest salvo just a bargaining chip, or does it signal deeper fractures in global trade relationships? Let’s break down the market reaction — and what investors should watch next.

Short-Term: Volatility in FX, Commodities, and Equities

- USDHKD saw a brutal stop-loss event as spot hit 7.8445, raising concerns that 7.85 may come under pressure soon.

- 1-year HKD swap rates spiked from -1280 to -1060 before easing, highlighting liquidity stress in the Asian dollar space.

- DXY made a small gain but reversed quickly, heading towards 99.00, reflecting cautious USD sentiment. (Reuters)

- EURUSD is steady around 1.1350, with 50dma at 1.1208 and topside resistance at 1.1420.

- Gold surged to a session high of 3316, spurred by Russia-Ukraine tensions and trade uncertainty.

- USDJPY is drifting lower, led by USD weakness, with 50dma support at 145.09.

Market Implication: Expect short-term volatility in metals, industrial equities, and currency pairs linked to trade-sensitive economies.

Mid-Term: Central Banks in the Spotlight

This week is packed with key central bank decisions:

- ECB: Expected to cut rates by 25bps, adding pressure on the euro and bond yields. (ECB)

- RBI: Also expected to cut rates by 25bps, signaling India’s commitment to growth amid global headwinds.

- BoC: Likely to hold, but with language that may hint at future moves depending on U.S. trade policy.

Additionally, FOMC speakers and the upcoming US labor market data (NFP at 125k consensus, unemployment at 4.2%) will shape mid-term rate expectations.

Market Implication: Central bank divergence may drive renewed FX volatility and challenge carry trades. Look for bond market sensitivity to any shifts in policy guidance, especially if trade tensions impact inflation expectations.

Long-Term: Trade Tensions and Geopolitical Fractures

Trump’s doubling of steel tariffs isn’t just about metals — it’s about signaling a readiness to use trade policy as a geopolitical weapon.

- The Russia-Ukraine conflict is heating up, driving safe-haven flows into gold.

- Germany’s hard data could reveal the real economic impact of trade wars on Europe’s largest economy.

- Global PMI releases will shed light on whether manufacturing is stabilizing or sliding further into contraction. (Reuters)

Market Implication: The growing weaponization of trade policy creates long-term uncertainty for global supply chains, investment flows, and commodity markets. Investors should prepare for de-globalization risk and consider allocating capital to real assets and regions less exposed to trade conflict.

Strategic Takeaways for Investors

Short-Term (1–2 weeks)

- Watch USDHKD closely — 7.85 is a key psychological and technical level.

- Stay nimble in gold and USDJPY — both could become safe-haven beneficiaries if trade tensions escalate.

- Monitor risk assets closely — equities may remain headline-driven and prone to reversals.

Mid-Term (1–3 months)

- Expect volatility in FX as central banks diverge and trade headlines evolve.

- Consider trimming risk in trade-sensitive sectors like industrials and autos.

- Position in defensive yield plays and select commodities to hedge trade uncertainty.

Long-Term (3–6+ months)

- Prepare for a structurally more volatile trade landscape.

- Build exposure to real assets, diversified global credit, and inflation-protected securities.

- Evaluate sovereign risk — trade conflicts can spill over into currency wars and debt sustainability challenges.

Final Thought

The Trump doubles steel tariffs headline may read like a one-off policy pivot, but its impact is global. As trade policy increasingly overlaps with geopolitics, markets must adjust to a world where volatility is structural, not cyclical.

Outbound Links

- Reuters: Trump doubles steel tariffs

- Bank of Japan

- European Central Bank

- World Gold Council

- U.S. Department of Commerce

No Comments