By Tigris Asset Management | May 2025

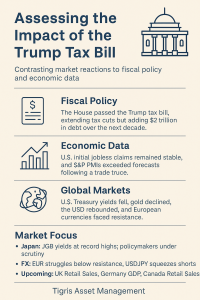

The U.S. House of Representatives has passed the Trump tax bill 2025, an extension of the previous tax cuts that is projected to add over $2 trillion in federal debt over the next decade. While this massive fiscal development might be expected to rattle markets, the reaction has been anything but disruptive.

Treasury yields cooled, the USD rebounded, gold sold off, and U.S. equities were largely flat. On the surface, this looks like complacency. Underneath, however, market participants are starting to acknowledge that we are entering a period of policy-driven distortion, where fundamental risks may be underpriced — for now.

Treasury Markets Defy Gravity

- After a brief spike, long-end Treasury yields fell, despite the debt-boosting implications of the Trump tax bill 2025.

- The market’s response was muted, likely due to a combination of:

- Month-end rebalancing

- Holiday positioning ahead of U.S. Memorial Day and UK’s May Bank Holiday

- Expectations that increased growth from tax cuts will offset supply-driven fears

But make no mistake: long-term debt sustainability is being repriced — just slowly.

USD and Gold React to Rotation

- The U.S. dollar bounced back, led by short-covering in USD/JPY and EUR/USD.

- EUR/USD reversed after failing to break through 1.1350, pressured by softer Eurozone PMIs (49.5 vs 50.6 consensus).

- USD/JPY found support around 140–142, with resistance near 145/146, driven by volatility in JGBs.

- Gold corrected, falling from recent highs as investors rotated into dollar-denominated assets — a temporary move in a longer de-dollarisation trend.

Japan’s Long-End Yields Signal Local Risk

- 30- and 40-year JGB yields rose to multi-decade highs, driven by:

- Pre-election fiscal concerns

- Weak auction demand

- The BoJ may be forced to step in if the long-end becomes disorderly — through adjusted QT or targeted purchases

- Meanwhile, Core CPI in Japan printed at 3.5%, above forecast, affirming Japan’s long-awaited inflation return

FX Market Movements: Unwinding and Hedging

- HKD volatility remains elevated, with sharp reversals likely driven by carry trade profit-taking

- In Asia, JPY and gold flows have become key signals for safe-haven sentiment, especially with rising Middle East geopolitical risk

Economic Data Ahead

As markets ease into the holiday weekend, investors should prepare for a fresh round of data surprises:

- UK Retail Sales

- Germany GDP

- Canada Retail Sales

- US New Home Sales

Each of these will test the durability of the “calm on the surface” regime that has followed the Trump tax bill 2025 announcement.

Investor Implications

Short Term (1–2 weeks):

- Expect low volatility with pockets of sharp reaction to data or geopolitics

- Gold dips may be buyable as fiscal and geopolitical tail risks are underpriced

- Stay nimble in FX, particularly in EUR/USD, USD/JPY, and HKD

Medium Term (1–3 months):

- The passage of the Trump tax bill 2025 is another step toward fiscal fragility

- Equities may stay buoyant, but bond markets will eventually reprice risk

- Position for increased demand for real assets and non-dollar exposure in portfolios

Conclusion: Calm Markets Don’t Mean Low Risk

The Trump tax bill 2025 is being digested quietly by the markets — but its long-term implications are far from benign. With U.S. debt ballooning and global rate differentials widening, we are moving into a structurally unstable regime where short-term calm masks long-term risk.

Investors should prepare not for panic — but for asymmetry. In these conditions, return is not about chasing momentum. It’s about anticipating imbalance.

Explore more insights on the Tigris blog

No Comments