By Tigris Asset Management

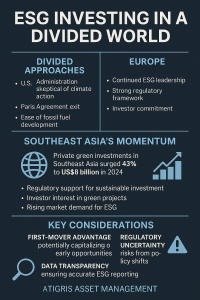

In 2025, the global approach to climate policy and ESG investing Asia is increasingly polarized. The United States, under President Donald Trump, has reversed many climate initiatives, withdrawing from the Paris Agreement and promoting fossil fuel development. In contrast, Europe continues to lead in ESG integration, with robust regulatory frameworks and investor commitment.

Asia’s ESG Momentum: A Closer Look

Amidst this divergence, ESG investing Asia emerges as a significant player in the ESG landscape. Private green investments in the region surged by 43% to US$8 billion in 2024, with Singapore and Malaysia leading the charge. This growth reflects both the region’s vulnerability to climate change and its potential as a hub for sustainable investment.

Southeast Asia’s rapid economic development and exposure to climate risks make it a focal point for ESG investments. Key factors driving this momentum include:

- Regulatory Support: Governments in the region are implementing policies to attract sustainable investments and promote green infrastructure. ASEAN policies

- Investor Interest: Both domestic and international investors recognize the long-term value in ESG-compliant projects, particularly in renewable energy and sustainable urban development. UNEP FI

- Market Demand: There’s a growing consumer preference for environmentally responsible products and services, encouraging companies to adopt ESG principles.

The Case for ESG Investing Asia Now

Given the current global dynamics, investors might consider the following:

- First-Mover Advantage: Early investment in ESG projects in Southeast Asia can position investors to benefit from future growth and policy support.

- Diversification: ESG investments in emerging markets offer diversification benefits, potentially reducing overall portfolio risk.

- Impact Investing: Beyond financial returns, ESG investments contribute to positive environmental and social outcomes, aligning with broader sustainability goals.

Cautionary Notes on ESG Investing Asia

While opportunities abound, investors should remain aware of potential challenges:

- Regulatory Uncertainty: Changes in political leadership or policy direction can impact the stability of ESG investments.

- Data Transparency: Ensuring accurate and reliable ESG reporting remains a challenge in some markets, necessitating thorough due diligence.

- Market Maturity: Some ESG sectors in Southeast Asia are still developing, which may affect liquidity and exit strategies.

Conclusion: ESG Investing Asia Opportunities

The global ESG landscape is marked by contrasting approaches, with the U.S. retreating from climate commitments and Europe doubling down on sustainability. Explore our ESG insights. Southeast Asia stands at a crossroads, offering both significant opportunities and challenges for ESG investors. Given the region’s growth trajectory and commitment to sustainable development, now may be an opportune time for investors to engage proactively, balancing potential rewards with mindful risk management.

No Comments