By Tigris Asset Management | May 2025

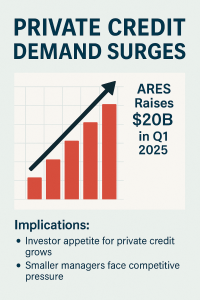

Private credit demand continues to dominate alternative asset flows and the numbers don’t lie. In Q1 2025 alone, Ares Management raised $20 billion, pushing its total assets under management to $546 billion, a 27% year-on-year jump.

This isn’t just a win for Ares. It reflects a seismic shift in investor behavior and a deepening conviction in the long-term value of non-bank lending amid a higher-for-longer interest rate environment.

Why Investors Are Flooding into Private Credit

1. Yield Premium in a Risk-Managed Framework

Private credit continues to offer attractive risk-adjusted yields, often in the 10–12% range, compared to traditional fixed-income products that remain constrained by rate and credit volatility.

2. Bank Retreat = Private Opportunity

As regulations tighten and traditional banks pull back from middle-market lending, asset managers like Ares are stepping into the gap. The ability to structure bespoke, secured loans gives private credit funds a clear competitive edge in both pricing and protection.

3. Portfolio Diversification + Downside Control

For institutions, private credit offers a rare combination: illiquidity premium, predictable cash flows, and collateral-backed downside protection—something especially appealing in late-cycle environments.

Implications for the Private Credit Market

1. Capital Inflow = Greater Competition

With major players like Ares attracting massive inflows, smaller and mid-sized managers will face pressure to:

- Differentiate via niche strategies or superior credit underwriting

- Avoid style drift in search of yield

- Invest in robust monitoring and risk controls

2. Structuring Discipline Becomes Critical

The flood of dry powder raises concern about loosening credit standards. To remain credible, managers must hold the line on:

- Strong collateral frameworks

- Proper covenants and guarantees

- Clear cash flow visibility and recourse structures

3. Liquidity and Exit Dynamics Under Watch

More capital means more lending—but also the need for exit planning. With rising rates and slower IPO/M&A exits, refinancing risks must be managed proactively.

Tigris Asset Management’s Perspective

At Tigris, we view this surge in capital as validation—but also as a call to stay disciplined, defensive, and data-driven.

Our Private Credit Fund emphasizes:

- Secured lending only: With collateral, PGs/CGs, and cash flow tracking

- SME and mid-market focus: Where underwriting skill matters more than scale

- Monthly risk monitoring: To adjust exposures ahead of stress signals

We welcome the capital flows—but remain cautious of the herd effect that often precedes late-cycle overheating.

Final Word

The fact that Ares raised $20 billion in one quarter underscores what we’ve believed for years: Private credit isn’t just an alternative—it’s becoming core.

But with great flows comes great responsibility. The next phase of this market will be defined not by who grows fastest—but by who manages risk best.

Read more about where to invest in 2025

No Comments