By Tigris Asset Management

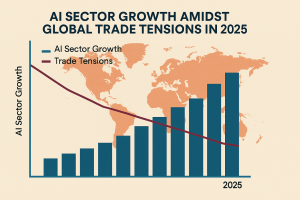

As global markets battle intensifying trade wars and policy uncertainty, AI market resilience is emerging as a stabilizing force. Despite macro volatility, strong quarterly earnings from tech leaders like Meta and Microsoft show that artificial intelligence remains a core growth engine in 2025. As investors navigate a market caught between booming tech optimism and rising geopolitical headwinds, one question looms: Can the strength of AI and Big Tech override the drag of trade wars and tightening liquidity?

This week, we saw a rebound in U.S. equities with the NASDAQ leading gains (+1.52%), powered by robust earnings from Meta and Microsoft, reaffirming that AI adoption and enterprise demand remain resilient—even amid economic uncertainty. Yet, beneath the surface, risks continue to percolate.

Can AI Market Resilience Continues to Drive Equity Momentum?

- AI Resilience: Meta and Microsoft’s earnings dispelled fears that AI investment would slow due to macro headwinds. Instead, we’re seeing stronger-than-expected revenue growth and solid user metrics.

- Tariffs and Trade Wars: New tariffs and the threat of escalation remain a wildcard. Although digital trade (like data tariffs) hasn’t been touched yet, it’s a space to watch—especially as AI infrastructure is data-intensive.

- ISM Manufacturing: Slightly better than expected at 48.7, but new export orders plunging to 43.1 suggests global demand weakness, likely tied to trade barriers.

- Dollar Strength: The DXY is firm above 100, and USDJPY above 145 after BOJ’s dovish revisions. We see potential for continued USD upside, especially with Japan holidays thinning liquidity.

- Gold Pullback: The metal has retraced 5% from April highs amid firmer USD. Still, up 20% YTD, reflecting systemic hedge demand.

What Could Happen Next?

We are at an inflection point:

- If NFP tonight beats expectations, it could reinforce USD strength and reprice Fed expectations for May 8.

- A tariff truce or at least an extended delay on digital tariffs could further boost tech and equity momentum.

- But if trade rhetoric worsens, stagflation becomes a more probable outcome, especially in export-sensitive economies.

Our View at Tigris

- We stay constructive on AI-linked equities, especially where fundamentals are strong and valuations aren’t yet overstretched.

- We are cautious on global exporters, particularly those with supply chain exposure to tariff zones.

- In Private Credit, we lean into secured, collateral-backed strategies that provide yield and downside protection—a crucial hedge in volatile markets.

- We maintain flexibility in FX, seeing further USD strength in near-term, but preparing for pivots as Fed and trade outcomes evolve.

Final Word

Markets may rally in the short term, but under the surface, risks are shifting. The winners will be those who balance offense with defense—capturing growth where it persists, while protecting capital with structure and discipline.

No Comments